Vertical Integration refers to: how much of the industry supply chain a firm controls internally.

The Ownership Test

Does a firm need to own all of its business in order to capture the value created from linkages across them?

- What should firm make and have inside under direct management control?

- What activities should firm allow others to provide for firm?

- Should firm engage in form of intermediate organization arrangement with 3rd party?

Market Failures and Transaction Costs

- Buy, or contract for, product or services from 3rd party suppliers (that’s the base assumption we should begin with)

- Compare costs of using market vs internal organizational hierarchy

- When transaction costs (using a 3rd party) exceed administrative costs, firm should integrate (and internalize the activity)

Markets/contracts usually fail because they’re not free, and the transaction cost is sometimes more costly than integration; thus prohibitively expensive.

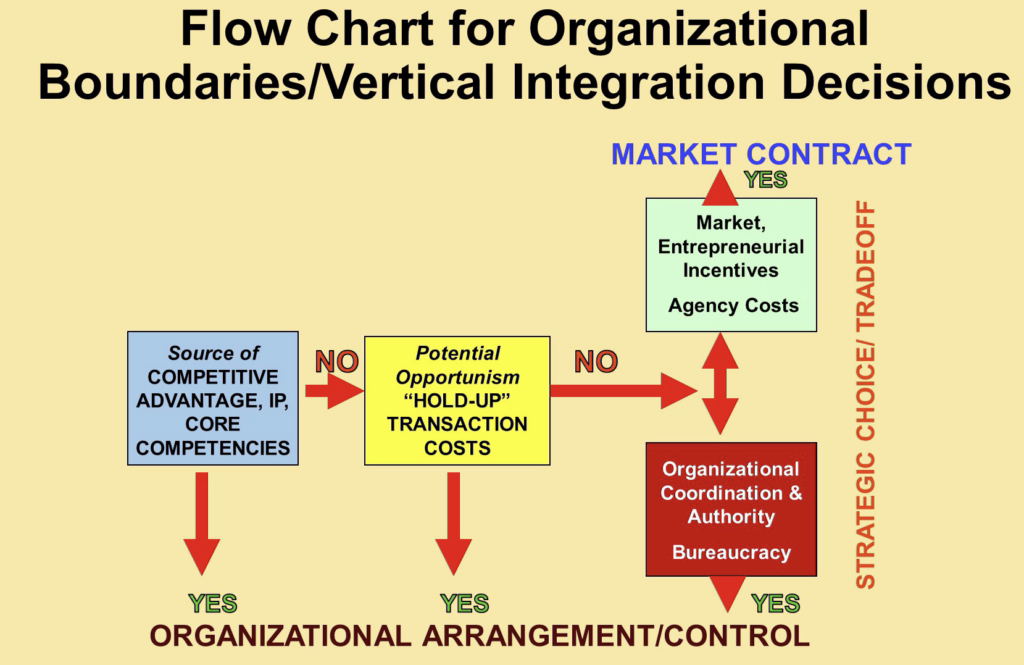

Framework for Organizational Boundaries/Vertical Integration Decisions

Factors of potential hold up:

- Bargaining problems

- Relationship specific investments

- Difficulties with property rights

- Future uncertainty

Intermediate organizational arrangements:

- Strategic alliance

- Joint venture

- Partial ownership

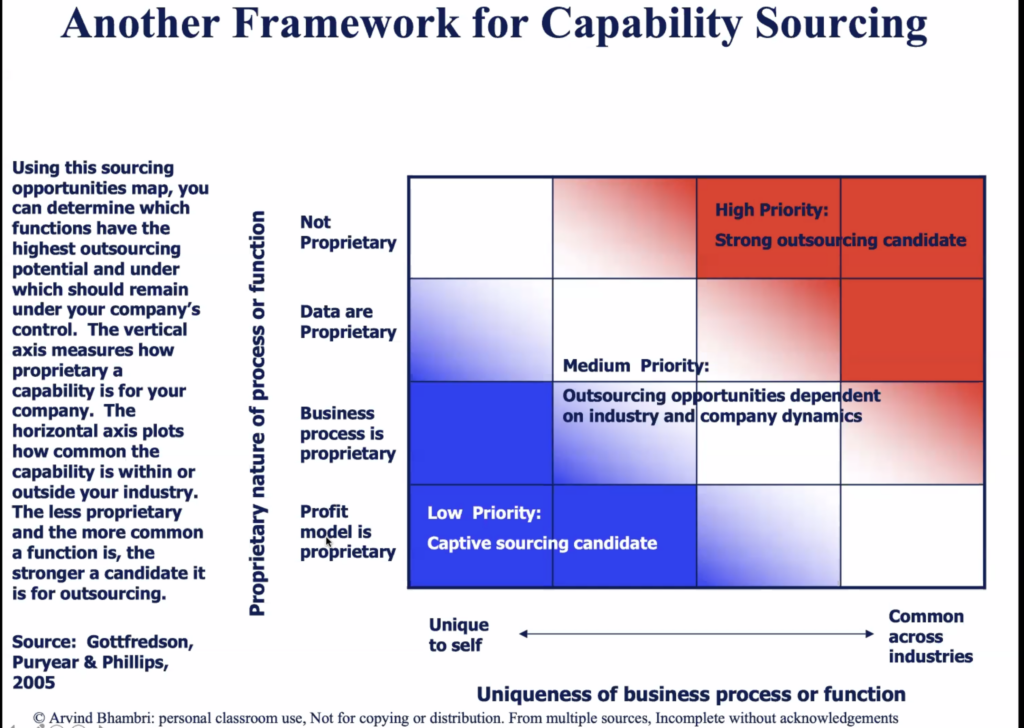

Outsourcing:

- Avoid irreversible commitments that come from integration

- Increased flexibility

- Frees up cash

- Avoid marking costly investment

Benefits of bringing activities inside the firm:

- Better coordination of activities

- Greater flexibility and control

- Advantages over markets