ADD SLIDES FROM FOLDER – LECTURE WEEK 3

ADD SLIDES FROM FOLDER – LECTURE WEEK 3

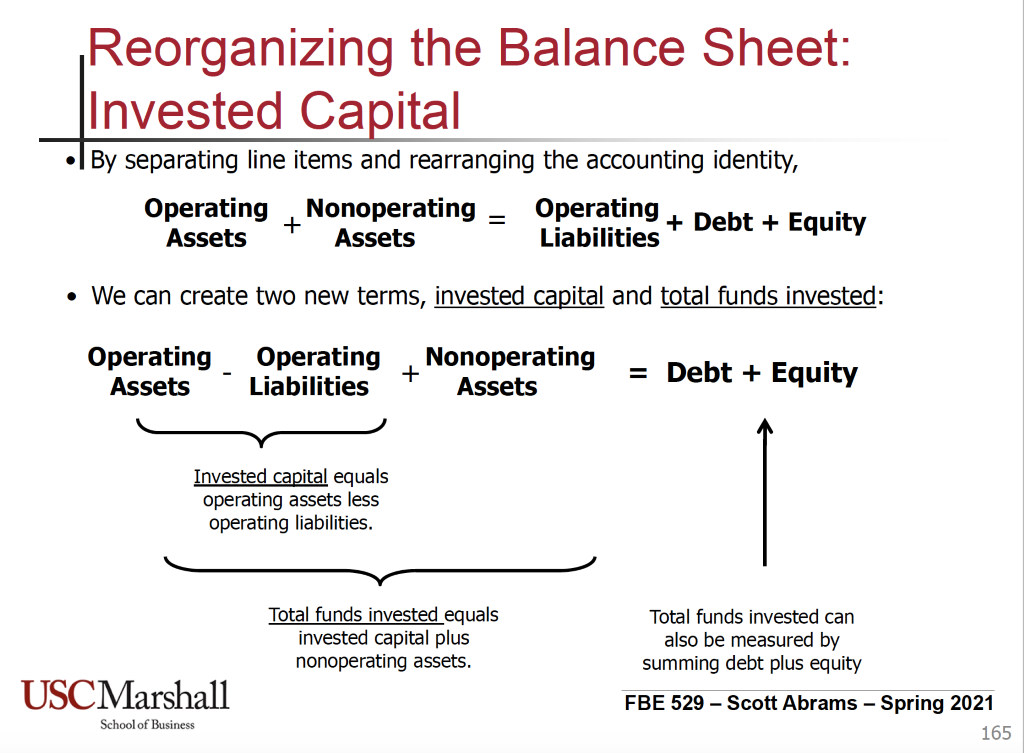

Liability VS Debt:

LIABILITY

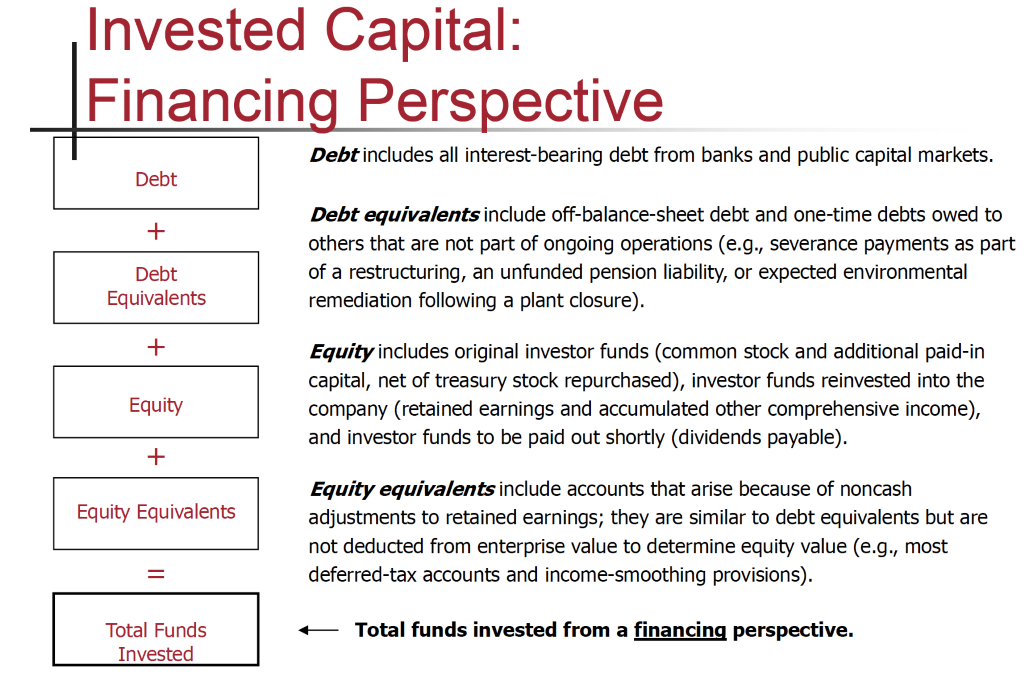

Accountants describes liability as a present contractual commitment to another entity that entrails settlement by probably future transfer or use of assets on an agreed upon date (or timing) when the obligating event has already occurred. There is no exact definition of debt in accounting, and not all liabilities are debt. Also, it is possible that some types of debt are not considered a liability by accountants (off-balance sheet financing).

DEBT

For our purposes, debt is an amount contractually owed to another party that has an explicit or implicit interest payment that we can measure. That includes notes, mortgages, bonds (debentures), and other financing instruments that typically have an explicit or implicit interest rate. That EXCLUDES liabilities such as deferred income taxes, unearned revenue, and most other operating liabilities (for example, accounts payable (AP), wages payable, accruals, etc.)

======================

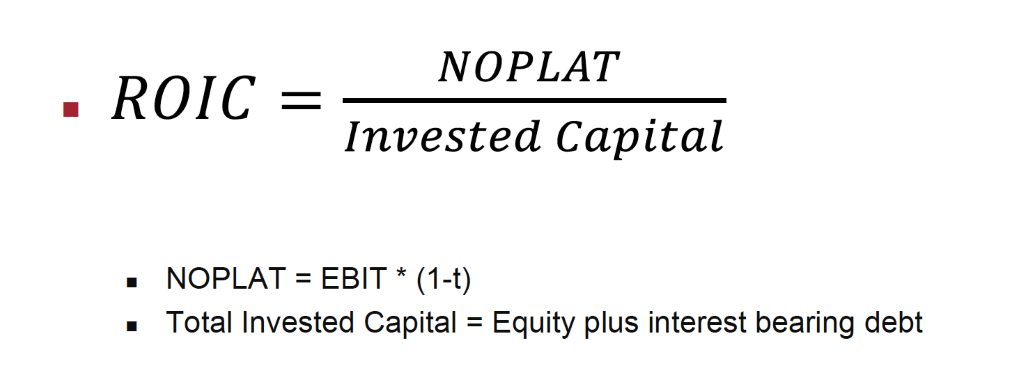

ROIC – Return On Invested Capital = NOPLAT/Invested Capital (=debt + equity)

NOPLAT = Net Operating Profits After Tax (to get the tax rate = taxable income/tax expense)

NWC (Net Working Capital) = current assets – current liabilities

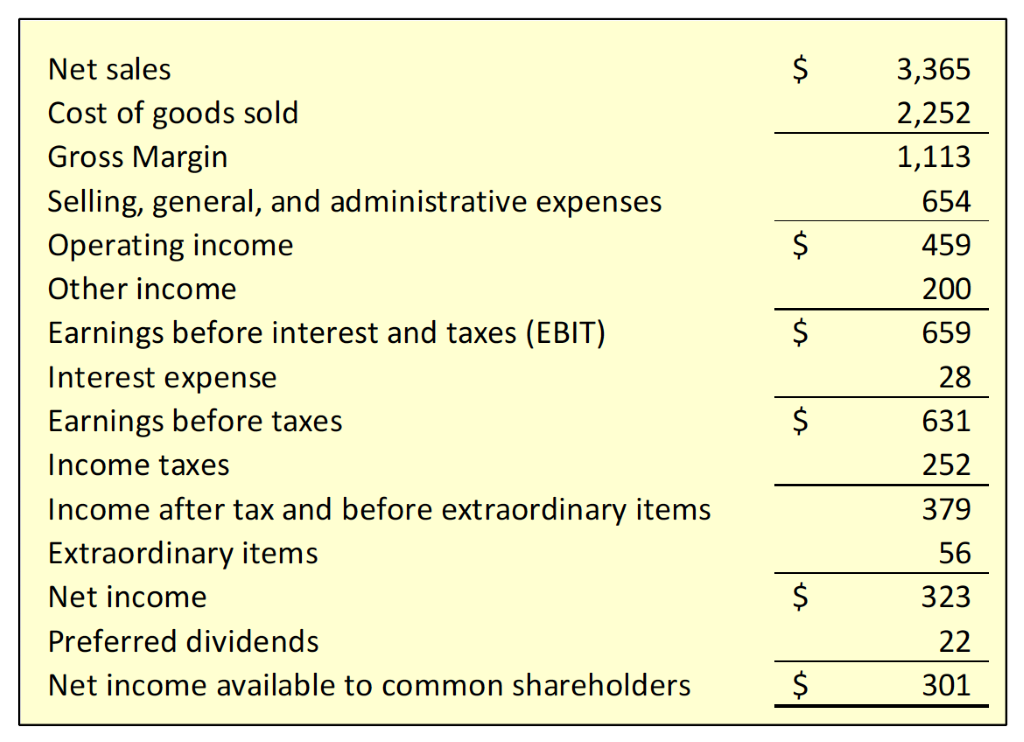

Income Statement: Operating income vs non-operating income – If we’re looking to value OPERATIONS ONLY, we’re stopping at the EBIT! After the EBIT come the financial performance.

Operating Income: the income generated by the firm’s core business operations.

Non-operating Income: income generated by investments the firm has made in assets that are unrelated to the firm’s primary business. For example:

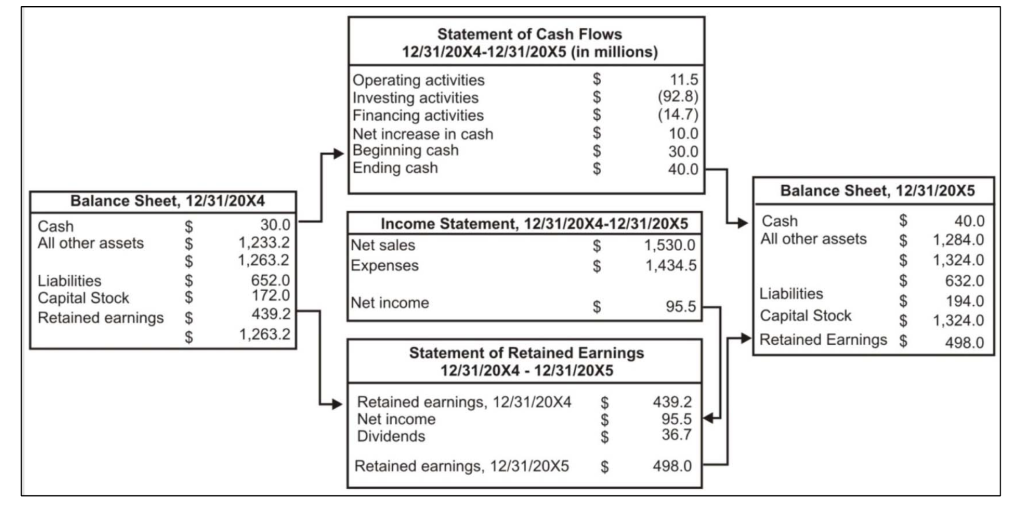

The Balance Sheet: provides a snapshot of the firm’s financial position at a moment in time and a detailed account of the company’s assets’ liabilities (debts), and shareholders’ equity. The balance sheet equation requires that the sum of the book values of the firm’s assets equal the sum of the debts the firm owes to its creditors plus the investment of the stockholders’ equity.

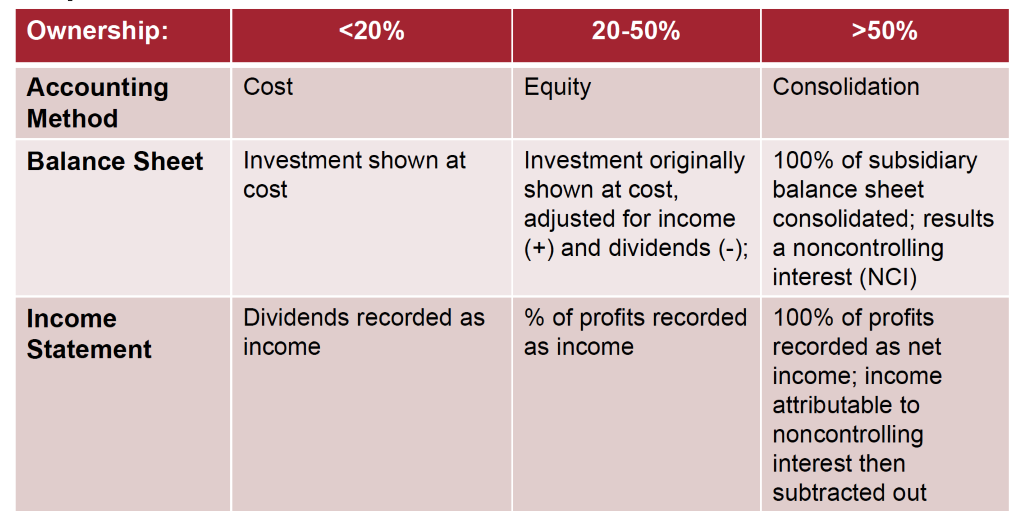

Consolidation Rules:

Categories of ratios:

Benchmarking using ratios: so, what is a good benchmark?

It is often not clear what is a ‘good’ or ‘bad’ level for a financial ratio and no one benchmark exists for all companies in all valuation contexts. We know ratios vary over time and we know they vary by industry – we also know that companies tend to regress towards the mean – so a common benchmark is the company’s industry or comparable group. That said – deviations from the ‘norm’ might be good and indicate an industry leader and a potential competitive advantage.

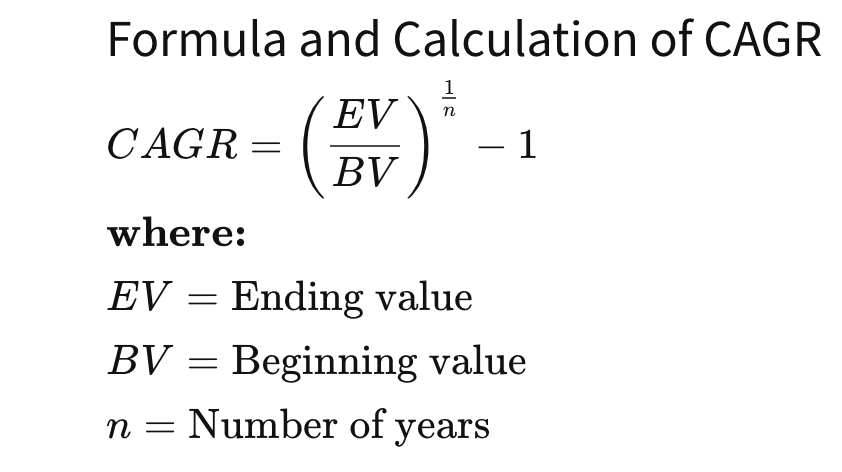

Sales Growth Rate (CAGR = Compounded Annual Growth Rate)

ales growth is an important driver of the need to invest in various types of assets and of the company’s value. It also provides some indication of the effectiveness of firm’s strategy and product development activities.

Analyzing Growth:

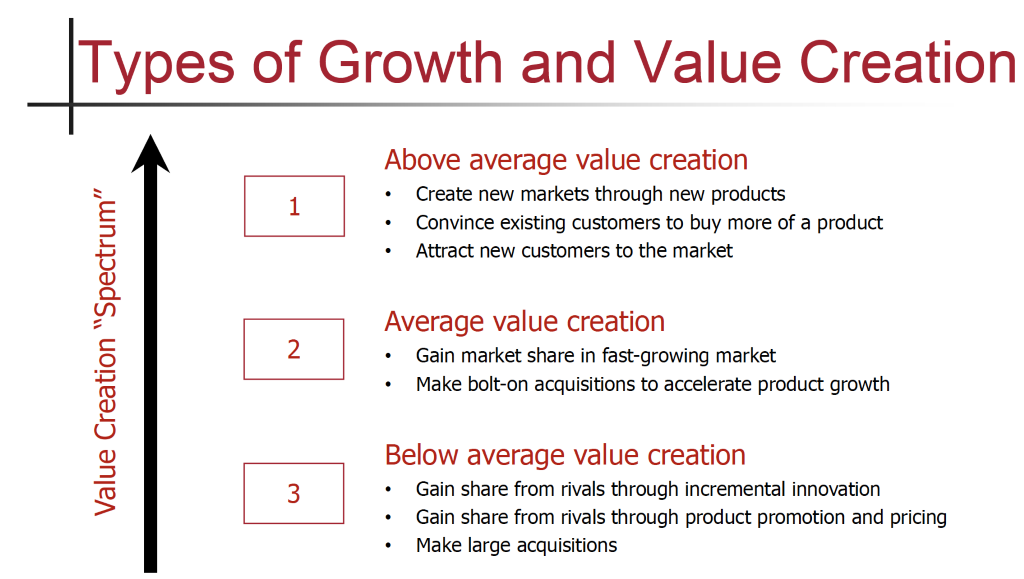

Growth can be disaggregated into three main components:

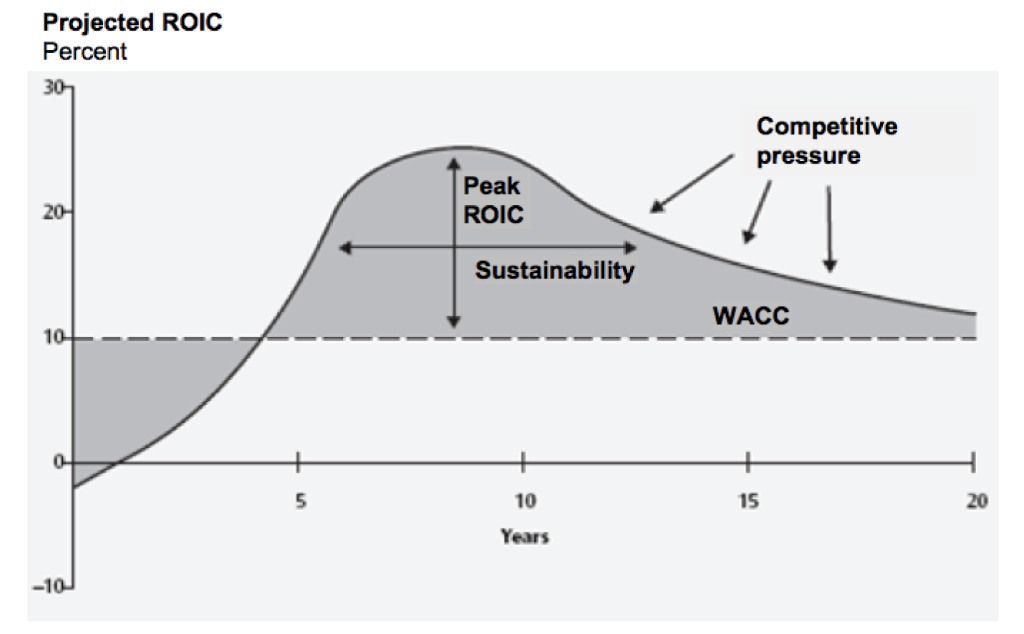

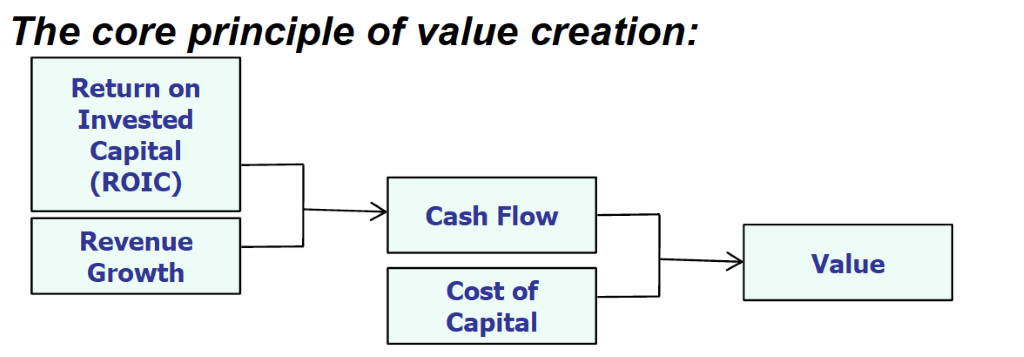

Growth and Value: growth translates to value when return on invested capital (ROIC) exceeds the cost of capital(!!!). Sustaining high growth is much more difficult than sustaining ROIC. Despite some variation on the patterns of growth, high growth is not sustainable, due to the natural cycles of products.

High ROIC companies should focus on growth. Low ROIC companies should focus on improving returns before growing.

The amount of value they (the company) create is the difference between cash inflows and the cost of the investment made, adjusted to reflect the fact that tomorrow’s cash flows are worth less than today’s because of the time value of money and the riskiness of future cash flows.

A combination of three primary financial metrics typically measure how well a company is delivering value to shareholders: earnings per share (EPS), return on invested capital (ROIC) or return on equity (ROE), and after-tax cash flow.

Warren Buffet’s principles for an outstanding business:

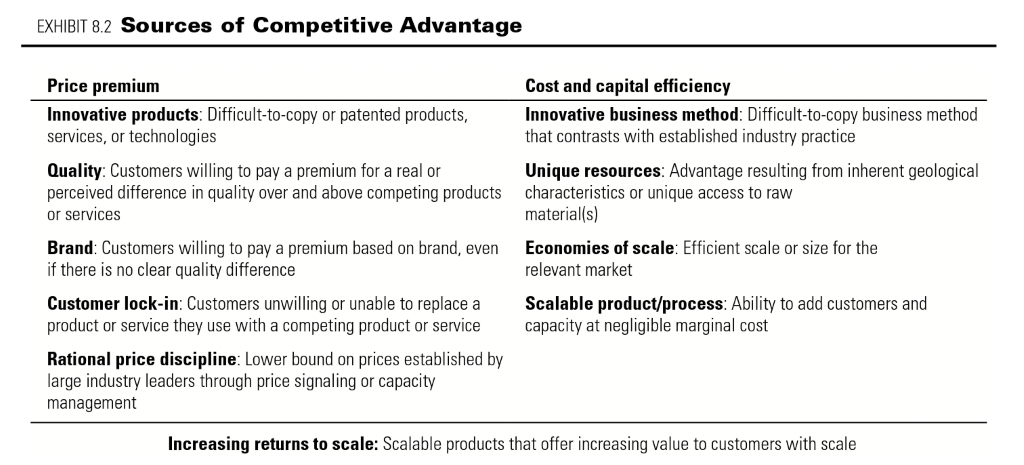

A large established company might have a low return on capital as it might have lost its competitive advantage (it grew at first thanks to its good ROIC). A small company might have a low return on capital as it struggled to ever establish and source of competitive advantage