- Intrinsic value: the value that WE THINK the company is worth. The actual worth of an investment or asset justified by information about its future cash flows. This is the ‘true’ value according to a model.

- Market value: the price determined by buyers and sellers on an open market. It’s the consensus value of all market participants.

- Is growth always good? It depends on the return on capital. Growth = IR (investment rate) * ROIC

- Invested Capital: the cumulative amount that the business has invested in its operations – primarily PP&E and working capital

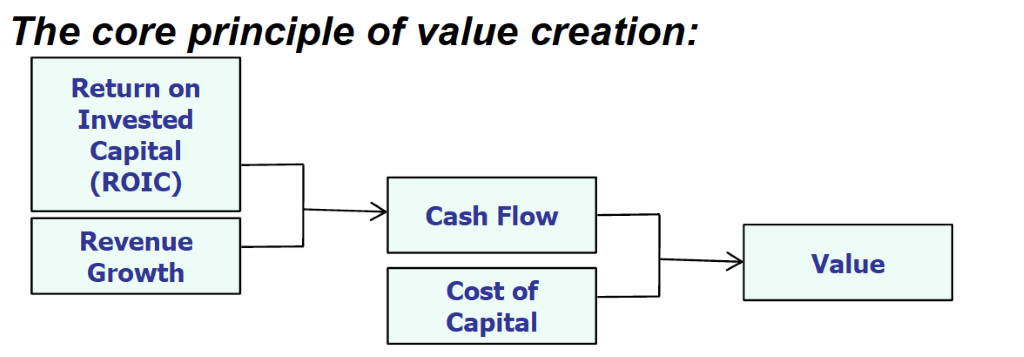

- Guiding Principal of Value Creation

- Firms that grow and earn a return of capital that exceeds their cost of capital create value

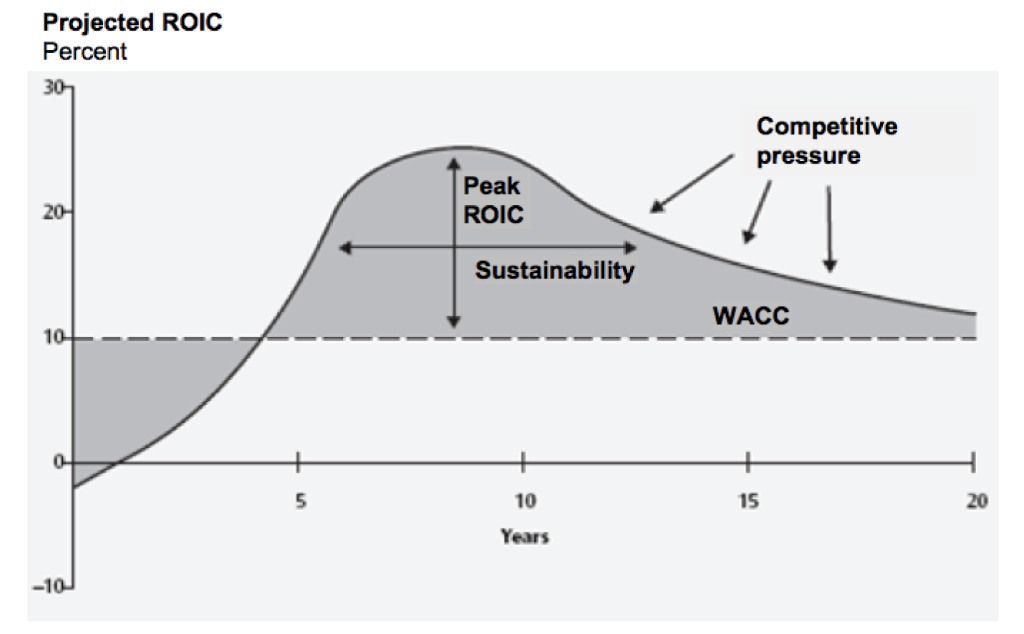

- As long as the spread between ROIC and WACC is positive, new growth creates value. The faster the firm grows, the more value it creates. ROIC > WACC = VALUE CREATION!

- If the spread is equal to zero, the firm creates no value through growth. The firm is growing by taking on projects that have NPV of zero

- When the spread is negative, the firm destroys value by taking on new projects. If a company cannot earn the necessary return on a new project or acquisition, its market calue will drop. ROIC < WACC = VALUE DESTRUCTION!

High ROIC companies should focus on growth. Low ROIC companies should focus on improving returns before growing.

The amount of value they (the company) create is the difference between cash inflows and the cost of the investment made, adjusted to reflect the fact that tomorrow’s cash flows are worth less than today’s because of the time value of money and the riskiness of future cash flows.

A combination of three primary financial metrics typically measure how well a company is delivering value to shareholders: earnings per share (EPS), return on invested capital (ROIC) or return on equity (ROE), and after-tax cash flow.

Warren Buffet’s principles for an outstanding business:

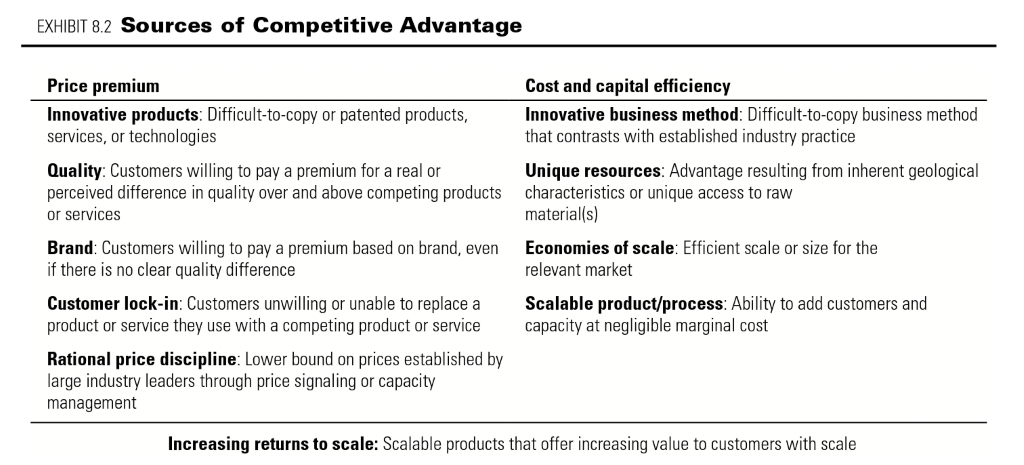

- A high ROIC and is able to reinvest its earnings at a high rate

- A “moat”, a barrier against competition, something like a world-class brand or advantage of scale. Often it is the firms business in a particular market

- Either an outstanding management or is so powerfully positioned that it doesn’t need one

A large established company might have a low return on capital as it might have lost its competitive advantage (it grew at first thanks to its good ROIC). A small company might have a low return on capital as it struggled to ever establish and source of competitive advantage