Liability VS Debt:

LIABILITY

Accountants describes liability as a present contractual commitment to another entity that entrails settlement by probably future transfer or use of assets on an agreed upon date (or timing) when the obligating event has already occurred. There is no exact definition of debt in accounting, and not all liabilities are debt. Also, it is possible that some types of debt are not considered a liability by accountants (off-balance sheet financing).

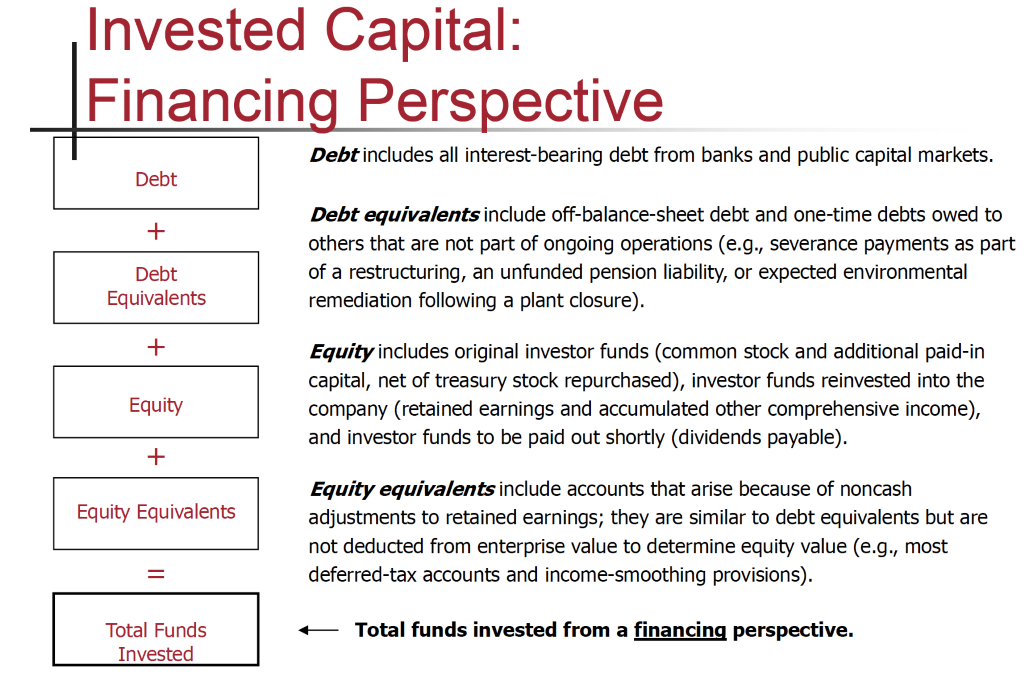

DEBT

For our purposes, debt is an amount contractually owed to another party that has an explicit or implicit interest payment that we can measure. That includes notes, mortgages, bonds (debentures), and other financing instruments that typically have an explicit or implicit interest rate. That EXCLUDES liabilities such as deferred income taxes, unearned revenue, and most other operating liabilities (for example, accounts payable (AP), wages payable, accruals, etc.)

======================

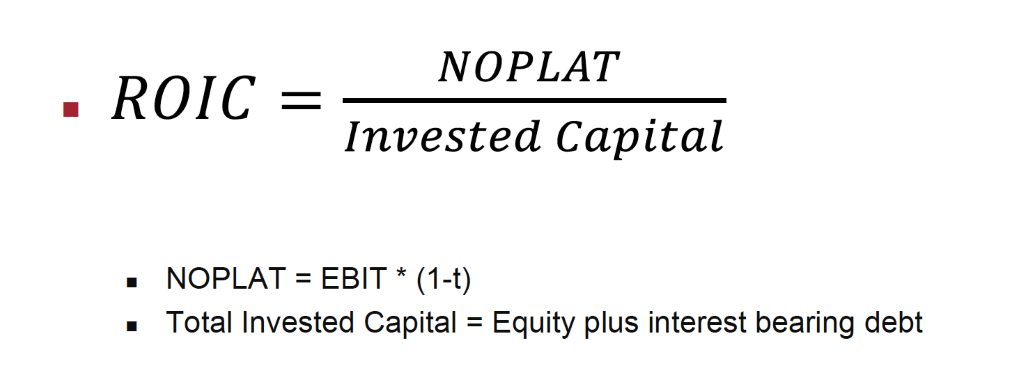

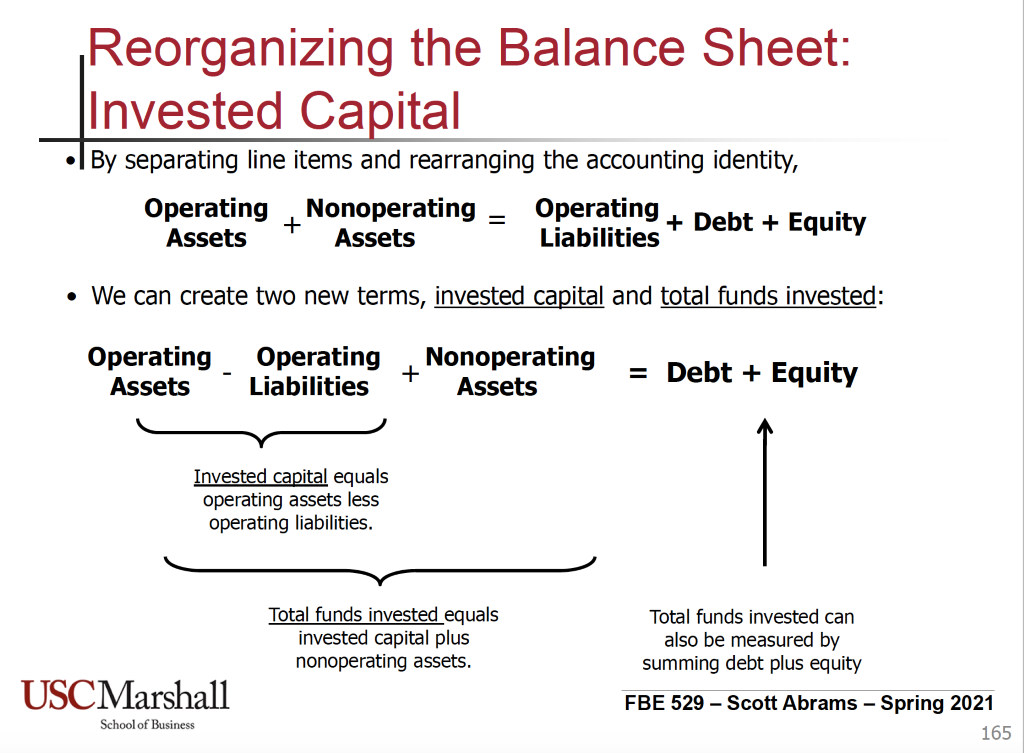

ROIC – Return On Invested Capital = NOPLAT/Invested Capital (=debt + equity)

NOPLAT = Net Operating Profits After Tax (to get the tax rate = taxable income/tax expense)

NWC (Net Working Capital) = current assets – current liabilities